Starting your journey as a dental nurse is exciting, but you might feel overwhelmed by some of the practical requirements – one of them being dental nurse indemnity insurance.

Understanding insurance policies and legal requirements may seem complex at first, but don’t worry, we’re here to simplify it. If you’re wondering what this is, why you need it, and how to get it, you’re in the right place. This guide will break everything down in simple terms so you can feel confident about your next steps.

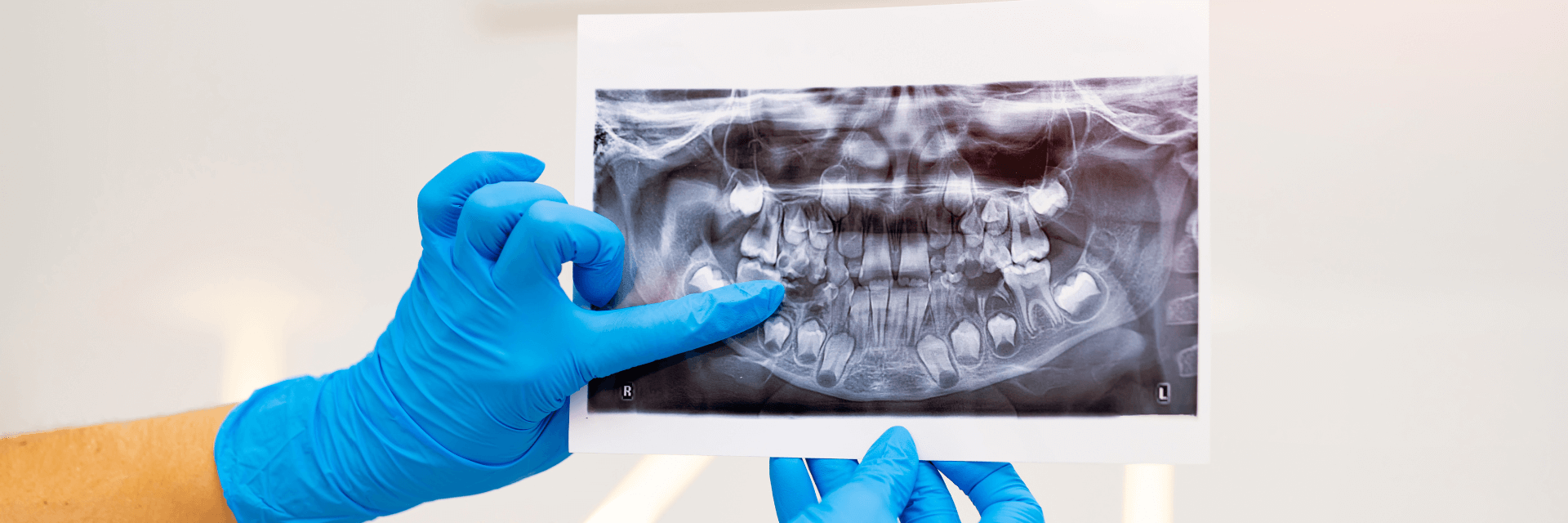

What is dental nurse indemnity insurance?

Dental nurse indemnity insurance UK is a type of coverage designed to protect you if something goes wrong while you’re working. If a patient makes a claim against you due to an error, accident, or complaint, this insurance helps cover legal costs and compensation.

In the UK, having dental indemnity for dental nurses is a legal requirement set by the General Dental Council (GDC). Without it, you cannot legally practise as a dental nurse. This requirement ensures that both patients and dental professionals are protected in case of unexpected situations.

Your indemnity insurance acts as a safety net, allowing you to work with confidence, knowing that should anything go wrong, you have the necessary support to handle it professionally and financially.

Why do dental nurses need indemnity insurance?

You may be wondering: Why do dental nurses need indemnity insurance? Simply put, it’s there to safeguard your career. While dental nurses play a vital role in patient care, mistakes can happen. Whether it’s an accident during a procedure, a mix-up with equipment, or a misunderstanding with a patient, professional indemnity dental nurse coverage ensures you’re financially protected against legal claims.

Without indemnity for dental nurses, you could face legal expenses and compensation claims that could significantly impact your financial stability and career. Having the right policy in place gives you peace of mind and allows you to focus on providing excellent patient care without added stress.

Additionally, many employers require proof of indemnity for dental nurses before you start working, so securing it early is essential to ensure a smooth transition into your dental nursing career.

What does dental indemnity cover?

The specifics of what dental indemnity insurance protects against can vary between policies, but typically, dental nurse insurance covers:

- Legal costs if a patient makes a claim against you, whether justified or not

- Compensation payouts if you are found liable for professional errors

- Allegations of professional misconduct or negligence

- Accidents or injuries that happen under your care

- Some policies may even offer mental health support for legal stress

It’s important to choose a policy that meets your needs, as not all indemnity insurance for dental nurses offers the same level of protection. Before purchasing a policy, make sure you read the fine print and understand exactly what’s included.

How much is dental nurse indemnity insurance in the UK?

Cost is a major concern for many aspiring dental nurses, leading to the question: How much is dental nurse indemnity insurance UK?

The price of indemnity insurance dental nurse policies depends on various factors, including:

- Your level of experience – Newly qualified dental nurses may pay lower premiums.

- Whether you’re employed or self-employed – Self-employed nurses may require more comprehensive cover.

- The coverage limits you choose – Higher coverage means higher premiums, but also greater protection.

On average, dental nurse indemnity insurance UK can range from £50 to £150 per year. Some employers may provide indemnity dental nurses coverage as part of their employment package, but it’s always best to check. If your employer does provide coverage, make sure to review the policy and ensure it meets the GDC’s requirements.

How to get indemnity insurance as a dental nurse

Getting indemnity insurance dental nurse coverage is straightforward, but it’s important to choose the right policy for your needs. Here’s what you need to do:

- Check with your employer – Some dental practices provide insurance for their staff, saving you the hassle of arranging it yourself.

- Look at professional associations – Organisations like the British Association of Dental Nurses (BADN) often offer discounted policies for members.

- Compare insurance providers – There are multiple insurers offering dental nurse indemnity policies, so shop around to find the best deal. Look for a balance between affordability and comprehensive coverage.

- Ensure it meets GDC requirements – Your policy must align with the GDC’s legal guidelines for dental indemnity for dental nurses. If you’re unsure, your training provider or employer can help clarify this.

- Read reviews and policy details – Make sure you understand what the policy covers and if there are any exclusions that could impact you in the future.

Get qualified with SmileWisdom

Starting a career as a dental nurse involves more than just getting the right insurance – you also need the right training. At SmileWisdom, we offer top-quality courses that fully prepare you for a successful career in dental nursing. Our expert tutors are dedicated to guiding you through essential topics like indemnity for dental nurses, making sure you understand what’s required and how to stay protected throughout your career.

With SmileWisdom, you’ll receive career guidance and the support you need to thrive in your role. We ensure that when you qualify, you feel confident not only in your practical skills but also in handling important professional responsibilities like securing the right dental nurse indemnity insurance.

If you’re ready to start your journey, enrol with SmileWisdom today and let us support you every step of the way!